Grade Gov creates a stir

If you’re trying to access www.gradegov.com, be warned that it may be a little slow. There are a whole lot of people trying to get in on the action. People are chomping at the bit to share what they think of their government officials.

If you’re trying to access www.gradegov.com, be warned that it may be a little slow. There are a whole lot of people trying to get in on the action. People are chomping at the bit to share what they think of their government officials.

But with a little patience, you can see which elected officers are making the grade and who is failing. Better yet, you can fail that guy you were ranting about last night or give your favorite member of Congress an A-plus.

An opinionated populace

The recession has hit home with a vast majority of Americans. The more people have to get short term loans, use credit cards or undergo mortgage loan modification to make ends meet, the more angry they become about the economy.

Now people who are angry because of losing their jobs or being buried in their mortgages have an outlet. GradeGov.com lets users write letters explaining their grades.

About GradeGov.com

The most surprising thing, to me, about Grade Gov is that it was created by an ex-elected official. The site’s slogan — “They work for you. Remind them” — does not sound like something a former Congresswoman would come up with. ... click here to read the rest of the article titled "Gradegov.com Lets You Fail Your Government Officials"

Despite outcry from shareholders and protests at Bank of America’s annual shareholder meeting today, Ken Lewis will retain his position as CEO of Bank of America.

Despite outcry from shareholders and protests at Bank of America’s annual shareholder meeting today, Ken Lewis will retain his position as CEO of Bank of America. By now, you probably know that circulation numbers for newspapers and periodicals are down. Numerous newspapers have either called it quits entirely or abandoned newsprint for the online-only format. Among other luminaries of print journalism, Dan Okrent, Edit0r-at-Large for Time, Inc., has

By now, you probably know that circulation numbers for newspapers and periodicals are down. Numerous newspapers have either called it quits entirely or abandoned newsprint for the online-only format. Among other luminaries of print journalism, Dan Okrent, Edit0r-at-Large for Time, Inc., has  Get it off your back

Get it off your back Thomas Jefferson

Thomas Jefferson  outdates its application to U.S. dollars and is still widely used as a peso sign throughout Latin America. ... click here to read the rest of the article titled "

outdates its application to U.S. dollars and is still widely used as a peso sign throughout Latin America. ... click here to read the rest of the article titled " Welcome back. CLICK HERE if you missed part four of this five-part article. Let’s close out this chapter of the “Repair Your

Welcome back. CLICK HERE if you missed part four of this five-part article. Let’s close out this chapter of the “Repair Your

A key element of how you’ll “Repair Your

A key element of how you’ll “Repair Your

The nerve!

The nerve! In 2007 the Rockefeller Center hosted a display of 100 million pennies collected by public school children. These children obviously loved pennies. But for many years a surging wave of adults has sought to abolish this humble coin. Grown-ups do not like pennies. Children may save pennies in a jar and use them to buy things. But if an adult puts a penny in a jar, it will stay there forever. Busy people simply throw pennies away.

In 2007 the Rockefeller Center hosted a display of 100 million pennies collected by public school children. These children obviously loved pennies. But for many years a surging wave of adults has sought to abolish this humble coin. Grown-ups do not like pennies. Children may save pennies in a jar and use them to buy things. But if an adult puts a penny in a jar, it will stay there forever. Busy people simply throw pennies away. appreciable value. The saying appears in "Four Last Things" written by English humanist scholar Sir Thomas More in 1522. (More, it should be noted, coined the word "utopia," but wore a hair shirt every day and was beheaded in 1535.) ... click here to read the rest of the article titled "

appreciable value. The saying appears in "Four Last Things" written by English humanist scholar Sir Thomas More in 1522. (More, it should be noted, coined the word "utopia," but wore a hair shirt every day and was beheaded in 1535.) ... click here to read the rest of the article titled "

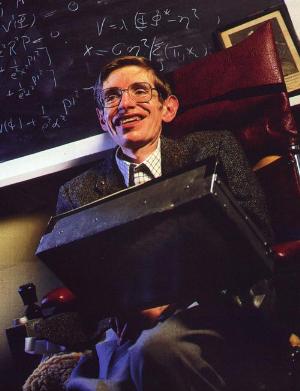

Many of us go through life without asking big questions. Where do we come from? What is our place in the universe? Merely keeping up with bills - whether you use

Many of us go through life without asking big questions. Where do we come from? What is our place in the universe? Merely keeping up with bills - whether you use  Eight states now have now received the dubious honor of having unemployment rates higher than 10 percent. The newest addition to the family is Indiana. The state hit 10 percent in March, up from 9.4 percent in February.

Eight states now have now received the dubious honor of having unemployment rates higher than 10 percent. The newest addition to the family is Indiana. The state hit 10 percent in March, up from 9.4 percent in February. Yes, joblessness is still going up. A total of eight states now have double-digit unemployment rates. However, there are still

Yes, joblessness is still going up. A total of eight states now have double-digit unemployment rates. However, there are still

Now we get to the nitty gritty of Danny Pang‘s Ponzi scheme, mixed in with other shenanigans that could cause honest people to question what they believe. CLICK HERE if you missed the beginning of this mini portrait of a 2009 cheat who has put people in need of

Now we get to the nitty gritty of Danny Pang‘s Ponzi scheme, mixed in with other shenanigans that could cause honest people to question what they believe. CLICK HERE if you missed the beginning of this mini portrait of a 2009 cheat who has put people in need of

Last time

Last time

GM and Segway have partnered to make a tiny, electric vehicle, the PUMA, that more closely resembles a scooter than a car. I shared my

GM and Segway have partnered to make a tiny, electric vehicle, the PUMA, that more closely resembles a scooter than a car. I shared my  Bob Ryan

Bob Ryan

President Barack Obama’s stimulus plan extended unemployment benefits by five weeks through Federal Emergency Unemployment Compensation. Now, Minnesota is taking that extension even further through the state program, allowing up to 13 weeks of additional unemployment benefits after the EUC runs out.

President Barack Obama’s stimulus plan extended unemployment benefits by five weeks through Federal Emergency Unemployment Compensation. Now, Minnesota is taking that extension even further through the state program, allowing up to 13 weeks of additional unemployment benefits after the EUC runs out. American banks are

American banks are

It has been rumored for weeks that IBM is considering buying Silicon Valley computing pioneer Sun Microsystems. Those rumors appear to be valid. Forbes magazine reports that the companies are inching ever closer to joining forces. Forbes also reports that said merger could result in 10,000 layoffs.

It has been rumored for weeks that IBM is considering buying Silicon Valley computing pioneer Sun Microsystems. Those rumors appear to be valid. Forbes magazine reports that the companies are inching ever closer to joining forces. Forbes also reports that said merger could result in 10,000 layoffs. Sun has long been known for its innovative technology. However, according to Forbes, IBM’s main motivation for this purchase is Sun’s customers, not its intellectual property.

Sun has long been known for its innovative technology. However, according to Forbes, IBM’s main motivation for this purchase is Sun’s customers, not its intellectual property. The indictment against Rod Blagojevich will reportedly be filed later today. Though federal prosecutors have until Tuesday to produce and indictment regarding a “significant criminal matter,” they say it will be done today.

The indictment against Rod Blagojevich will reportedly be filed later today. Though federal prosecutors have until Tuesday to produce and indictment regarding a “significant criminal matter,” they say it will be done today.

Hold on.

Hold on.